Do you envy those who seem to have all their finances under control, be it sticking to a budget, investing in the right sectors, or being up-to-date with the finances? They have it all covered.

Earlier, you needed to track spending in a spreadsheet and make constant calculations to get there. Still, with the introduction of personal finance apps, you, too, can manage your expenses without breaking a sweat.

In this article, we will mention a few perks of using personal finance apps:

- You Can Set (and Stick To) a Budget

Creating a strong budget is one of the key aspects of having a strong financial future. You must know the main components of a budget to be able to create one that suits your lifestyle the best. You must keep track of the revenue that is coming in through the various sources, including the payments bank. Also track the expenditures, the savings, and more.

This usually takes hours to track, but with the help of a personal finance app, you easily know how you are spending and what the areas are where you can save money. The most challenging part is sticking to a budget. Thankfully, these apps will help with that as well.

- Avoid Late Fees

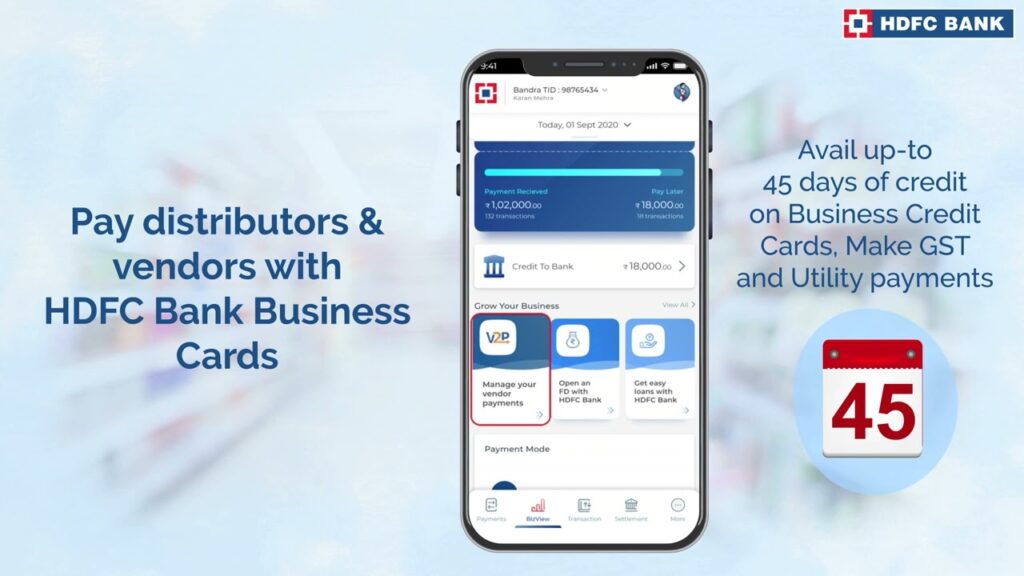

If you have a series of credit card bills and EMIs to pay at the end of each month. It is best to use a personal finance app to help make these payments on time. Late payments will not only drop your credit score but also impose a late fee penalty, which will disrupt your whole budget. To avoid extra charges make the payment using a personal finance app that also works as a merchant app.

These apps will help you establish a separate section in your budget where you keep money saved for making these monthly payments without fail.

- Assess Your Spending Habits

Once you establish a budget, you get to learn a lot about your spending habits. You get to know where you are spending the majority of your money. Also, it helps you identify the areas where you can save up money.

It also helps you monitor the payments for business, including bills, essentials, and other factors. If you are spending too much on a certain thing, you need to take a step back and lower the money that you regularly spend on such things.

This will again help you save money and establish an emergency fund that you can use to make a big purchase or to handle a rough financial period.

- Reach Your Financial Goals

Once you start saving money and keep track of your finances, your short-term and long-term goals become more clear. This means you can work your way towards achieving your insta business goals with more clarity and confidence.

Conclusion:

It feels great to be in control of finances. While it used to be an uphill task earlier, the introduction of personal finance apps and payment processing solutions has made it much easier. We hope that the points mentioned above convince you to take charge of your finances with the help of a personal finance app.