In the constantly changing realm of individual finance, credit cards have become all-pervasive instruments for handling costs and constructing credit. Yet, several credit card holders struggle to manage their invoices and prevent past-due payments effectively. To tackle this problem, several credit card bill payment platforms have introduced distinct advantages as motivations for timely payments.

This article will investigate the significant influence of unique advantages on credit card bill payment behavior.

- The influence of incentives

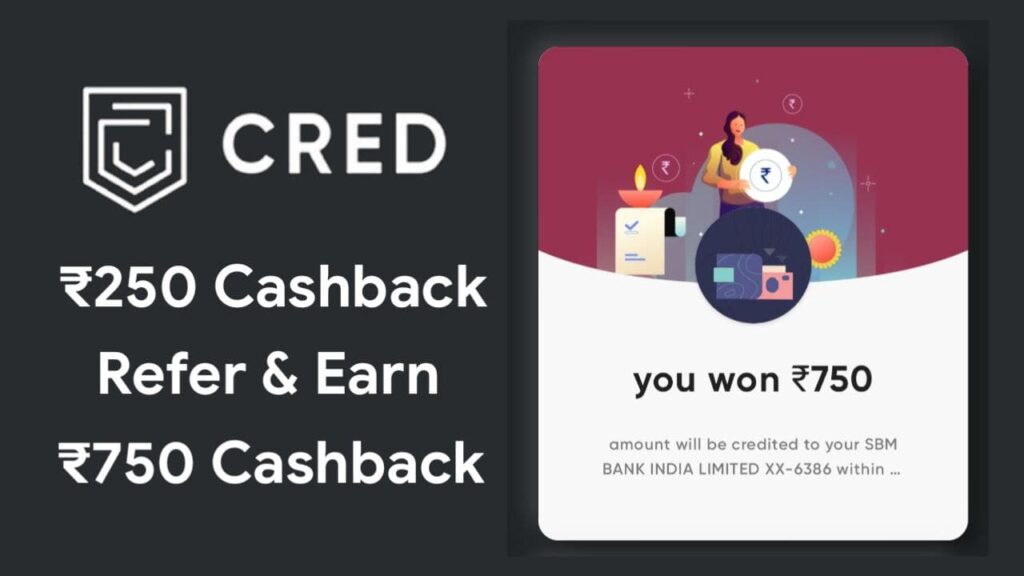

Incentives have an impact, on how people behave. This applies to our financial habits as well. Credit card companies have cleverly tapped into this understanding by providing rewards to encourage cardholders to pay their bills. These rewards can vary from cashback to your UPI app and discounts to access, to top tier services and exclusive experiences known brands offer.

- Fostering Financial Responsibility

One of the most significant impacts of exclusive rewards on credit card bill payment behavior is the encouragement of financial responsibility. Knowing that they can earn valuable rewards on UPI payment by paying their bills on time, cardholders are more likely to prioritize timely payments. This, in turn, helps individuals build a healthier financial profile by reducing late fees and avoiding high interest charges.

- Improved Credit Scores

Timely credit card bill payments are crucial in determining an individual’s credit score. A higher credit score opens up better borrowing opportunities, lower interest rates, and improved financial stability. Exclusive rewards serve as an additional motivation for cardholders to protect and enhance their credit scores. By consistently paying their bills on time, they can reap the benefits of a stronger credit profile.

- Reduced Financial Stress

Late credit card payments often lead to financial stress and anxiety. When cardholders are uncertain about their ability to pay bills on time, it can cause sleepless nights and strained relationships. Introducing exclusive rewards helps alleviate this stress by providing a clear and tangible benefit for those who meet their payment deadlines.

- Enhanced Loyalty and Customer Satisfaction

Credit card companies that provide special benefits for punctual payments also gain from amplified client fidelity and contentment. Customers are more prone to adhere to a credit card supplier that acknowledges and compensates their accountable monetary conduct. This allegiance results in a more steady consumer foundation, decreasing turnover and acquisition expenditures for the credit card corporation.

- Changing Spending Habits

Another intriguing aspect of exclusive rewards is their potential to influence spending habits. Cardholders who are actively seeking to earn rewards may become more mindful of their spending and budgeting. This shift toward responsible spending can have a lasting positive impact on financial health.

- A Catalyst for Financial Education

Introducing incentives also offers an opportunity to educate credit card users about responsible financial practices. Credit card companies can provide resources, tips and tools to assist individuals in managing their finances. This educational aspect is beneficial for credit card holders. Helps build a relationship between the card provider and its customers.

As credit card companies continue to innovate in this field the future appears promising for both cardholders and the financial industry. Whether you have been using credit cards for a time or are new, to the concept of credit it is evident that exclusive rewards are transforming how we approach paying our credit card bills ultimately resulting in financial security and empowerment.